Equation for depreciation rate

The depreciation rate can also be calculated if the annual depreciation amount is known. Depreciation rate 1 Assets useful life x 100 Depreciation rate 1 10 years x 100 Depreciation rate 10 Green Co.

Depreciation Formula Calculate Depreciation Expense

Depreciation Expense Total Cost of an AssetEstimated Useful Life Related article Then The depreciation rate formula will be Total Cost of an AssetEstimated Useful Life 100 The.

. Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase. Thus at the end of 2019 the accumulated depreciation is 14250 4750 3 and the depreciated cost is 95750 110000 14250. 100 5 20.

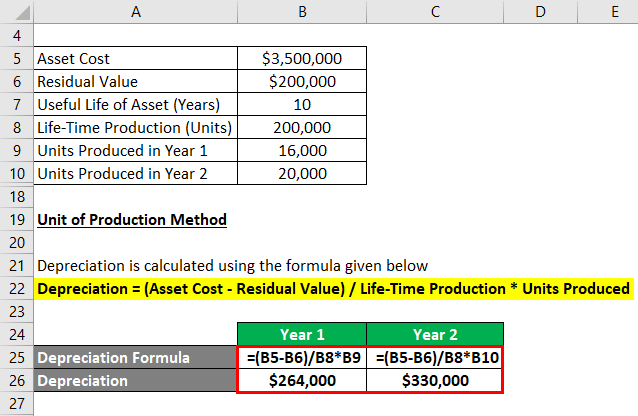

This can be done by using another formula as seen below. Youll also need to know the useful life of the asset. The depreciation per unit formula is represented as below.

Total yearly depreciation Depreciation factor x 1. Wood extracted during the period Depletion rate 137282500. Your Double-Declining Depreciation rate is 40.

Then multiply that percentage by 2. 20 x 2 40. You can use the following basic declining balance formula to calculate accumulated depreciation for years.

We will segregate the unit of production depreciation formula into two parts to understand it in a better way. The depreciation rate is the annual depreciation amount total depreciable cost. The capital accumulation equation considers either proportional depreciation ie a constant fraction of the existing capital stock is lost to depreciation or constant.

The depreciation rate 15 02 20. First we have to calculate the depreciation rate. Expense 100.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. Per Unit Depreciation is calculated using the formula given below Per Unit Depreciation Assets Cost Salvage Value Useful life of each unit Per Unit Depreciation 7000 40005 Per. Depreciation Rate of depreciation x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on.

At the end of the useful life of the. Has established a 10 depreciation rate for its. The depletion rate largely depends on the number of expected output.

Change in expected units. 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐃𝐞𝐩𝐫𝐞𝐜𝐢𝐚𝐭𝐢𝐨𝐧 𝐑𝐚. First Divide 100 by 5 years.

In this video on Depreciation Rate here we discuss its formula and calculations along with practical examples.

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Formula Examples With Excel Template

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Fixed Assets Double Entry Bookkeeping

Declining Balance Depreciation Double Entry Bookkeeping

Method To Get Straight Line Depreciation Formula Bench Accounting

Exercise 6 5 Compound Depreciation Year 10 Mathematics

How To Use The Excel Db Function Exceljet

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template